Time is Money! We’ve all heard that expression. It is so true even though we don’t think about it that way very often. But time is a very real commodity that all of us get the same amount of and we have to use it wisely. So it is one of the factors that comes in to play when Shawna and I are making financial decisions.

I recently saw this movie trailer that got me thinking about my time as money.

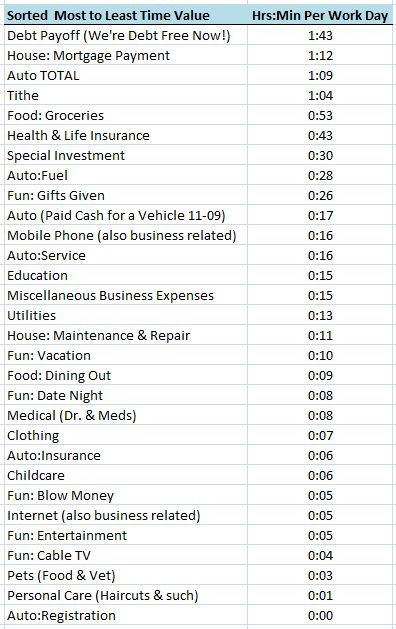

So I decided to calculate my per hour earnings based on about how many hours I work on average per work day, and I used the past two years of my Quicken data to do this. I went through all our spending categories to drill down how much each is costing me in terms of time. Then I consolidated it all into the summary lists below (Alphabetical and Most to Least):

I left the Automobile category split into subcategories to show that number is still being significantly impacted by our latest family minivan purchase at the end of 2009. That van has also been the worst vehicle ever for repairs. I’m still betting by the time we’re done with this van I’ll still be winning The Used Car Gamble. I also wanted to point out that gasoline (category Auto: Fuel) is by far the most significant portion of our overall auto expense. We drive a lot. Can you imagine how much our auto expenses would be if we added car payments along with higher new car insurance and registration? Auto expense is one area of our finances we have been pretty smart about from the beginning of our marriage (unlike some other categories).

There are categories on here that are encouraging to see how they fall in the time-value. One of them is tithe. I already knew the dollar amounts and that it is 10% of gross etc etc. But seeing that it is also 10% of the amount of time I work is another way of affirming my obedience to God.

Another encouraging category is a special investment I was able to make as soon as we got debt free. I don’t have saving on here because the report I generated in Quicken is only for spending. If I had included saving it would probably be near the top of the “Most To Least” list and would reduce every other time value by about 10%. Yes – I have made saving a priority even while paying down debt.

That brings me to one of the most encouraging categories to see – debt repayment. I could look at it as a depressing thing that sucked my time for the past two years, but I’m actually psyched out of my mind to have almost 2hrs a day of my work going from debt repayment to more productive things. I’m gonna be out of control when I get my house paid off – hopefully in the next five years.

One last thing to note about these lists is Shawna’s income is not accounted for in here. She does work and make a little bit of money, but her full time job is homeschooling our kids. So while I don’t have Shawna’s income or savings in the equation I do have an investment that was made with the savings in there and I do have categories that are business expenses that should technically be taken out of personal expenses. The net result is this is a pretty good way for me to look at what my time pays for.

Dr. John Maxwell is a bestselling author on the subject of leadership. He did a word-of-the-day on time that puts this whole topic in perspective. Watch it here.

Speak Your Mind