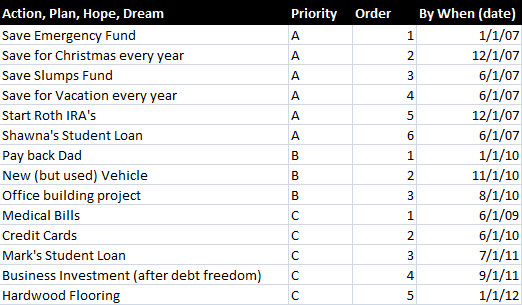

A couple of weeks ago I introduced the Money-Do-List, a tool to help prioritize our list of hopes, plans, and dreams (goals) in a way that makes sense for where we are and where we want to be and what is important to each of us. When Shawna and I first started using this method our list consisted of mostly boring stuff by me and mostly fun stuff by Shawna. All I wanted to do was pay down our debts and save. But Shawna was tired of having no life and wanted to at least have Christmas memories and maybe a vacation. Here’s how we used the money-do-list method to compromise (all of this list is complete now):

Keep in mind December 2006 is when we went to Financial Learning Experience and got Financial Coaching for the first time. Notice we did a lot of saving before we did anything else, and the saving included fun. I wanted to get the discipline of saving started right away so that we would have margin when the unexpected happened.

We actually tackled the debts one at a time, so for example there were multiple credit card bills and medical bills listed separately rather than just one-liners. I’m sure I’ve forgotten some of the things that were on our list along the way, but this is a pretty good representation of how we prioritized the completion of things – making sure to complete practical things (debts & margin) as well as fun things (Christmas & vacation) along the way.

Sometime in the near future I’ll share what’s still coming up on our list and how it is prioritized. How are you using the money-do-list?